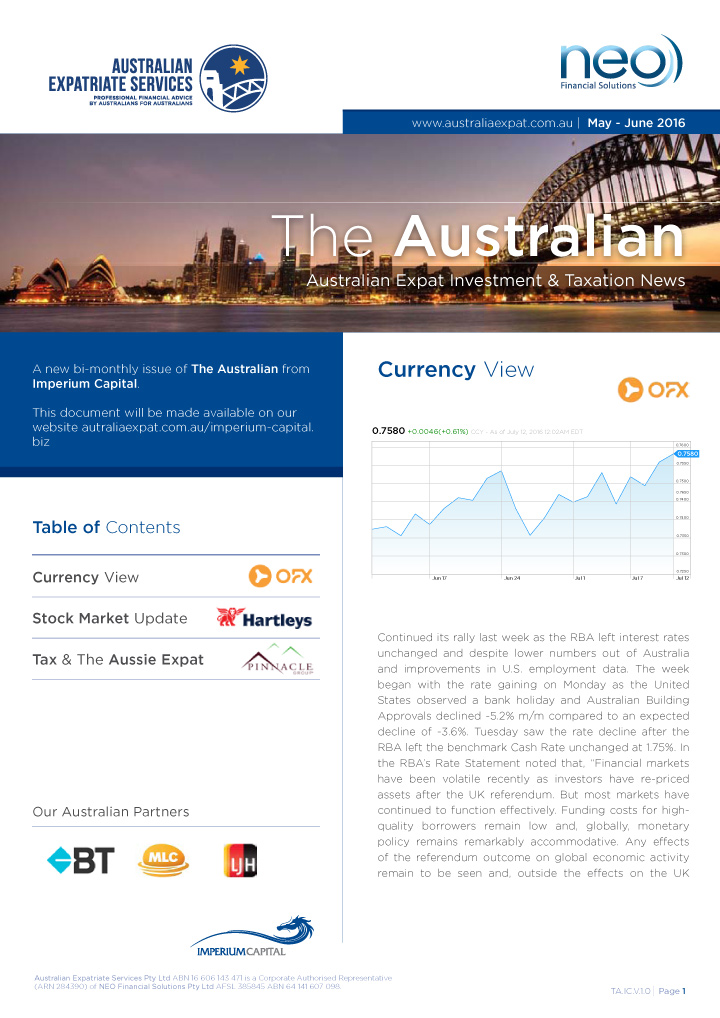

Currency View by OFX

Last week’s news

- The UK’s public finances is reaching a record deficit for the 2020-21 period, with the central government borrowing £221.2bn in the first 5 months of the financial year. The extra borrowing which took place between April-August, is 11 times greater than the highest ever cash borrowing figure between those months since records began 36 years ago and debt is now over 100% of the UK’s gross domestic figure for the first time since the 1960’s. Analysts calculated that if borrowing continues in this way, it would lead to a total level of borrowing of 14% of national income for the whole of 2020-21.

- Donald Trump has refused to commit to a peaceful transfer of power if he loses the election. When asked by the media if he would be happy to transfer power peacefully, he replied ‘we are going to have to see what happens’. Mr Trump repeated his message that the mail ballots being posted to millions of voters in order to vote via post instead of at polling stations, was an ‘out of control’ disaster. Trump seems keen to replace the 9th seat on the high court, which became vacant following the death of Ruth Bader Ginsburg, before the US elections.

- As expected, the US equity market weakness experienced since the beginning of September has supported haven demand for USD. The USD increased 1.62%, 3.54%, 3.15%, 1.77%, and 1.32% versus CAD, AUD, NZD, EUR, and GBP respectively. Last week, global news around a “second wave” on the northern hemisphere as winter comes closer kept the Greenback well bid. Furthermore, real rates have been picking up since the start of September, providing more support to the USD. The USD usually moves in the opposite direction from gold. Gold fell 4.58% last week, while the USD index increased 1.85%.

- In Australia, Debelle speech did not give further insights into potential RBA cuts to close the year and even though equity markets across the Globe recovered on Friday, the Aussie was not able to close the week above the previous short-term support level around 0.7060. Expect focus to move into October 6 Federal Budget announcement.

Looking ahead

- The Swiss National Bank said it was ready to accelerate huge interventions in foreign currency markets, as successive bouts of economic uncertainty have placed upwards pressure on the Swiss Franc. The Swiss economy has been hit far less than expected by the COVID-19 pandemic in the first half of the year with GDP contracting only 5% nonetheless the SNB still intends to pursue its ultra-expansionary monetary policy for the foreseeable future. The CHF is considered a haven during times of uncertainty hover the SNB are keen to keep its currency from regaining too much strength as its high value would put off foreign investors and be disastrous for Swiss manufacturing and export-oriented industries. The SNB already has their interest rates at -0.75%, which remain the lowest in the world.

- The increase in volatility might continue this week. Market participants will start to follow the vote on a $2.4 trillion fiscal package. Furthermore, President Trump takes on Joe Biden on Tuesday during the first presidential debate ahead of what is likely to be a tense election at the beginning of November. The most traded currency after the USD is the EUR, which is under pressure following new coronavirus cases in parts of Europe. Also, yesterday, ECB Governing Council member and Bank of Italy Governor Ignazio Visco said that he’s not counting on advances in the fight against COVID-19. Finally, the British Pound had a net increase over the last week versus G10 currencies as the EU and UK head into another round of Brexit talks. Towards the end of the week, eyes will focus on the release of the US non-farm payrolls report (Friday).

Key market events this week

- USD CB Consumer Confidence MoM (Sept)- Tuesday

- CNH China Caixin manufacturing PMI- Wednesday

- GBP UK GDP Growth Rate YoY (Q2)- Wednesday

- EUR Core Inflation Rate YoY (Sept)- Wednesday

- USD GDP Growth Rate YoY (Q2)- Wednesday

- USD Core PCE Price Index YoY (Aug)- Thursday

- USD ISM Manufacturing PMI (Sept)- Thursday

- USD Non-Farm Payrolls (Sept)- Friday

- USD Unemployment Rate (Sept)- Friday

- USD University of Michigan Consumer Sentiment & Expectations (Sept)- Friday

Disclaimer

Note that specialist Accounting, Property, Mortgage and Foreign exchange services offered by our partners, Stoneturn, OFX, Hartley’s and LJ Hooker are via referral arrangement only. Australian Expatriate Services are not responsible for any advice/services provided by these Firms.