Interest Rate Update – Shore Financial Newsletter January 2016

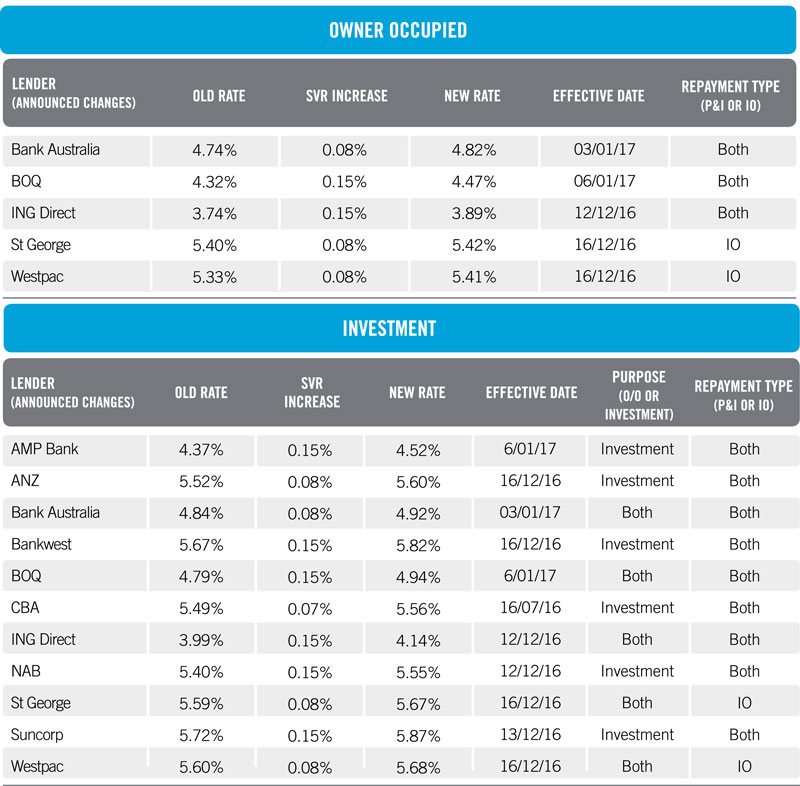

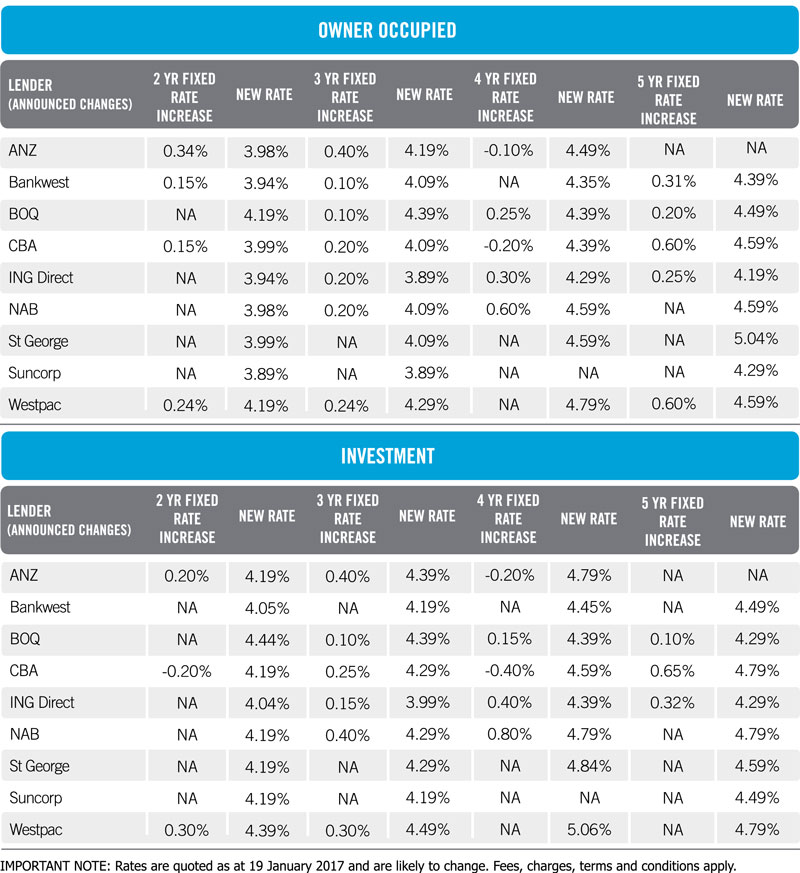

Since early December, majority of banks announced an increase to their Fixed Rates, Owner Occupied Rates and Standard Variable Investor loan Interest Rates.

With investor home loans typically higher than interest rates for owner occupied home loans, this increase can add roughly an extra one thousand dollars per annum in interest.

Regardless of whether your investment property is negatively geared or income generating, it’s important to make sure you’re getting the best possible loan structure for your individual circumstances and financial goals. At Shore Financial, we can connect you with loan products from a wide range of lenders, with rates often far more competitive than what you’d get as a direct customer.

To arrange a no-obligation financial health check of your investment property loan, contact your Australian Expatriate Services Representative today at d.casson@australiaexpat.com.au

Since early December, majority of banks announced an increase to their Fixed Rates, Owner Occupied Rates and Standard Variable Investor loan Interest Rates.

With investor home loans typically higher than interest rates for owner occupied home loans, this increase can add roughly an extra one thousand dollars per annum in interest.

Regardless of whether your investment property is negatively geared or income generating, it’s important to make sure you’re getting the best possible loan structure for your individual circumstances and financial goals. At Shore Financial, we can connect you with loan products from a wide range of lenders, with rates often far more competitive than what you’d get as a direct customer.

To arrange a no-obligation financial health check of your investment property loan, contact your Australian Expatriate Services Representative today at d.casson@australiaexpat.com.au

Disclaimer

Note that specialist Accounting, Property, Mortgage and Foreign exchange services offered by our partners, Stoneturn, OFX, Hartley’s and LJ Hooker are via referral arrangement only. Australian Expatriate Services are not responsible for any advice/services provided by these Firms.